Implementing emotional interaction in the finance app

Find a unique value proposition for an emerging digital bank

My role:It's a team project. I was responsible for the finance bubble, participated in research and ideation.

Solution:A payment system that helps users understand themselves, have mindful experience about money and feel satisfied with their money relationship.

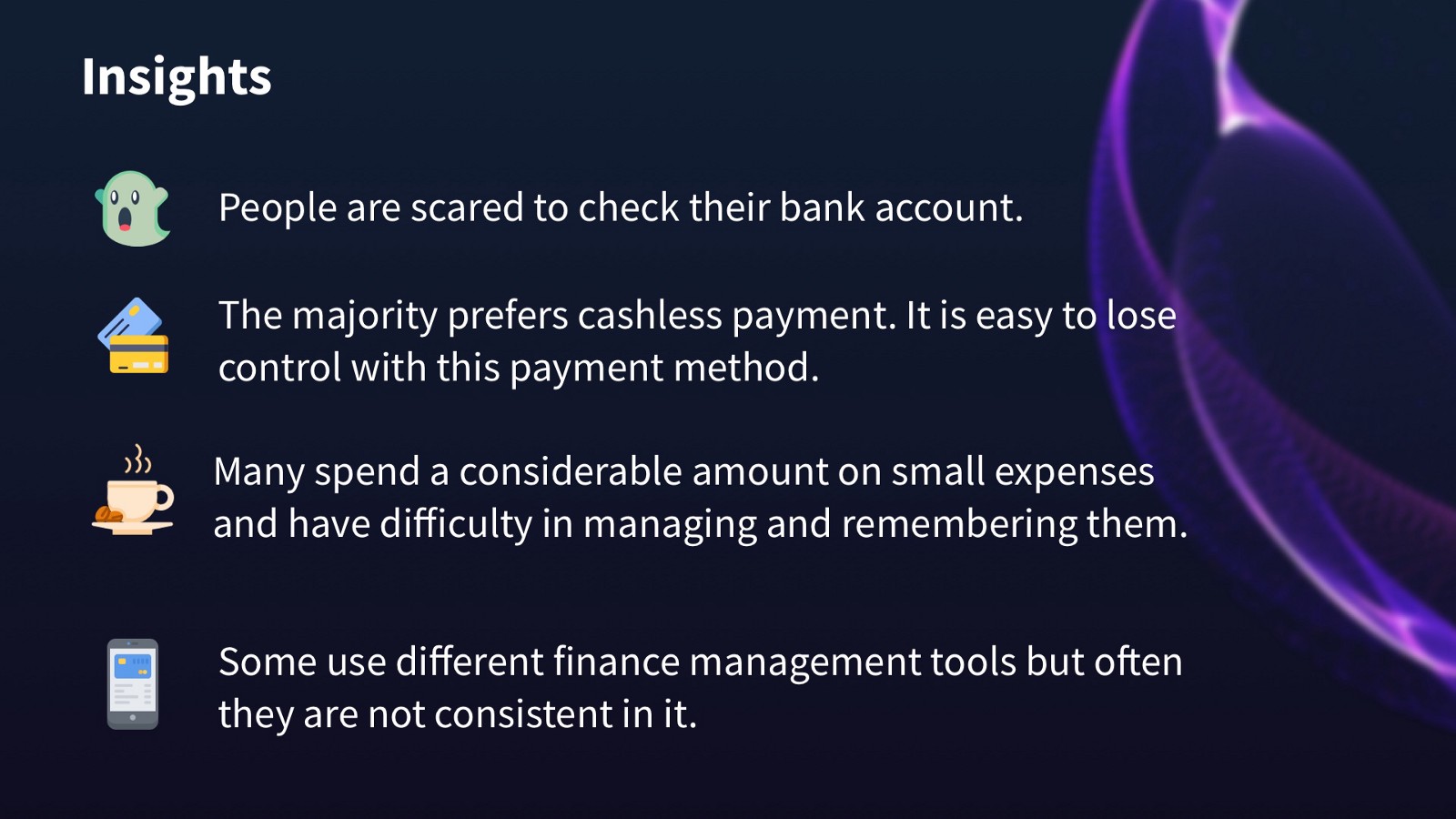

With cashless payments, many lose control over their bank account. People make unnecessary purchases without even noticing it. And then they are afraid of checking their bank account. Our team challenged themselves to solve this problem. And provide users with a desirable product that facilitates positive emotions.

How do Millennials manage their finances?

Our team was focusing on the millennial's financial behavior. We found three types of purchase behavior. The first one is “rational”. These people are mindful of the moment of purchase. But they are not good at tracking their bank account.

The second type is “impulsive”. As you could guess these people tend to make impulsive purchases. They can spend a considerable amount on small purchases aiming for immediate joy.

“Entrepreneur” is the third. They spend a lot of energy on keeping track of the spendings, regularly check the account, and don't make thoughtless purchases.

All three types found that cashless payment is more difficult to control because it's not tangible. Small expenses are especially unnoticeable. Many respondents don't count them when planning their budget.

What might be the solution?

To develop a solution we have to understand what value for the user we want to provide. We decided to help users understand themselves, have mindful experience about money and feel satisfied with their money relationship.

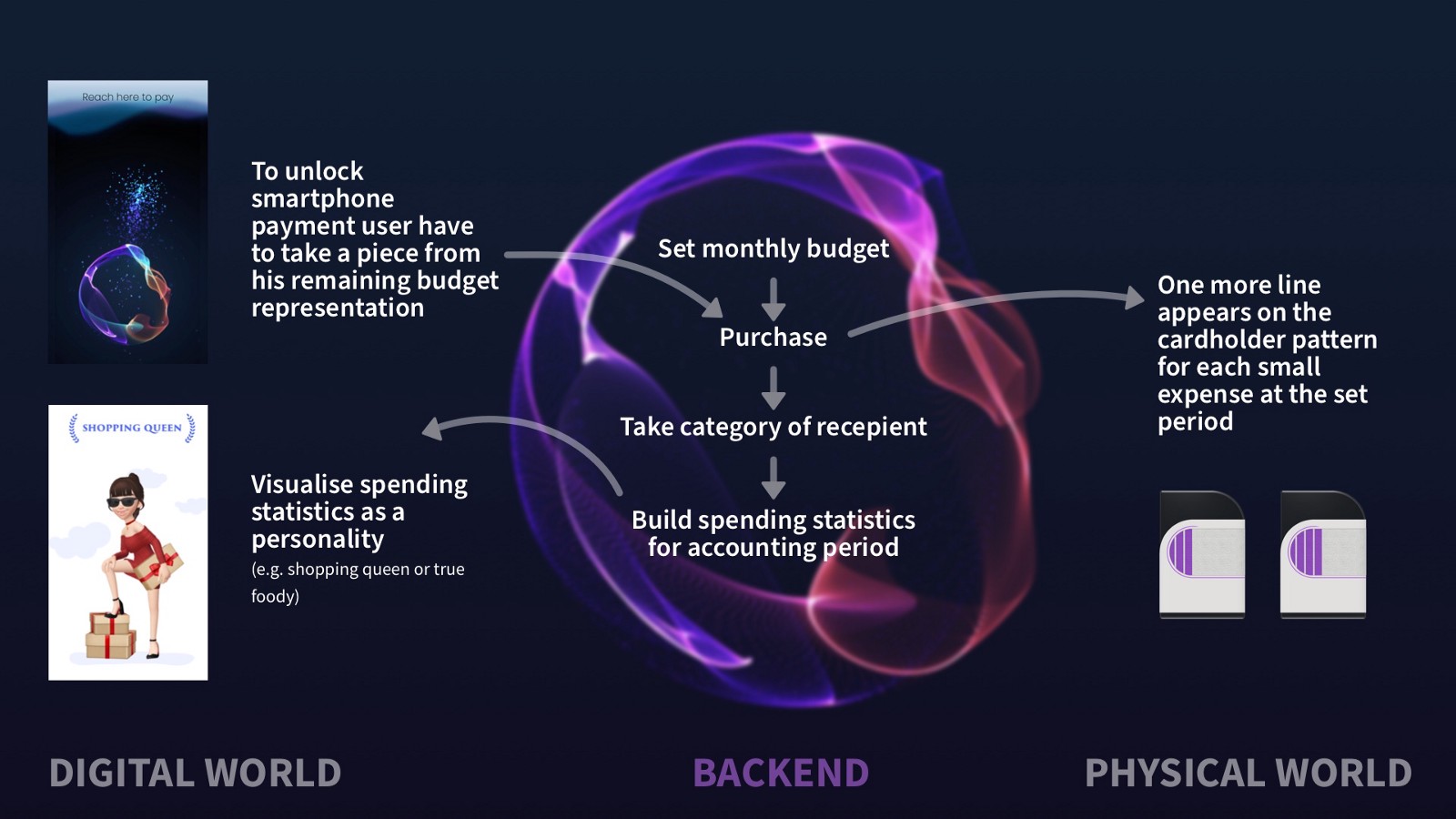

We covered two ways of cashless payment: with the smartphone and with the card. At these moments we are providing users gentle visual feedback on their financial situation. To help people understand more about themselves and how they spend money we also designed different personalities. They appear at the end of the month and represent the spending history.

Smartphone payment

With the smartphone payment, we faced a challenge. How to keep the simplicity of the payment but give it more meaning and tangibility. We wanted to give people feedback on their financial situation every time they pay and don't stress them with numbers. So we created a visual metaphor of their budget and the act of taking money from this budget.

- The bubble represents a budget left

- Colors relate to the shopping categories

- To unlock an NFC payment, users must pinch off a small piece of their budget

- Every time before purchase, the user gets a picture of the left budget without being stressed by the numbers

It was important to make the metaphor visually appealing. It's not graphs, numbers, or charts as all financial products usually are. It is something more human, live. Watch the video for details.

Card payment

Another part of our system is a cardholder that shows small expenses. It is made of an innovative fabric that can change color. Every time a small expense is done a line is added to the cardholder.

The feedback on small purchases helps to create awareness. These expenses go usually unnoticeable, so we visualize it. Again with no stress on numbers.

Expenses overview

We created an awareness in the moment of payment. But what about understanding yourself part? Can we help people with that?

We are doing it again through visual metaphor and gamification. Every month the application delivers a new personality based on the expenses categories during the accounting period.

To make users empathize with the personality and gamify the process the application is delivering it through AR. First, the personality should appear on the user's bank card and only then it transfers to the application. This way we are connecting the metaphor with the acts of payment.

A new personality appears only once a month. It helps to keep users motivated to spend according to who do they want to be. And also creates curiosity in the moment of discovering.

How the system works altogether

Previous project

InchNext project

Automotive UI